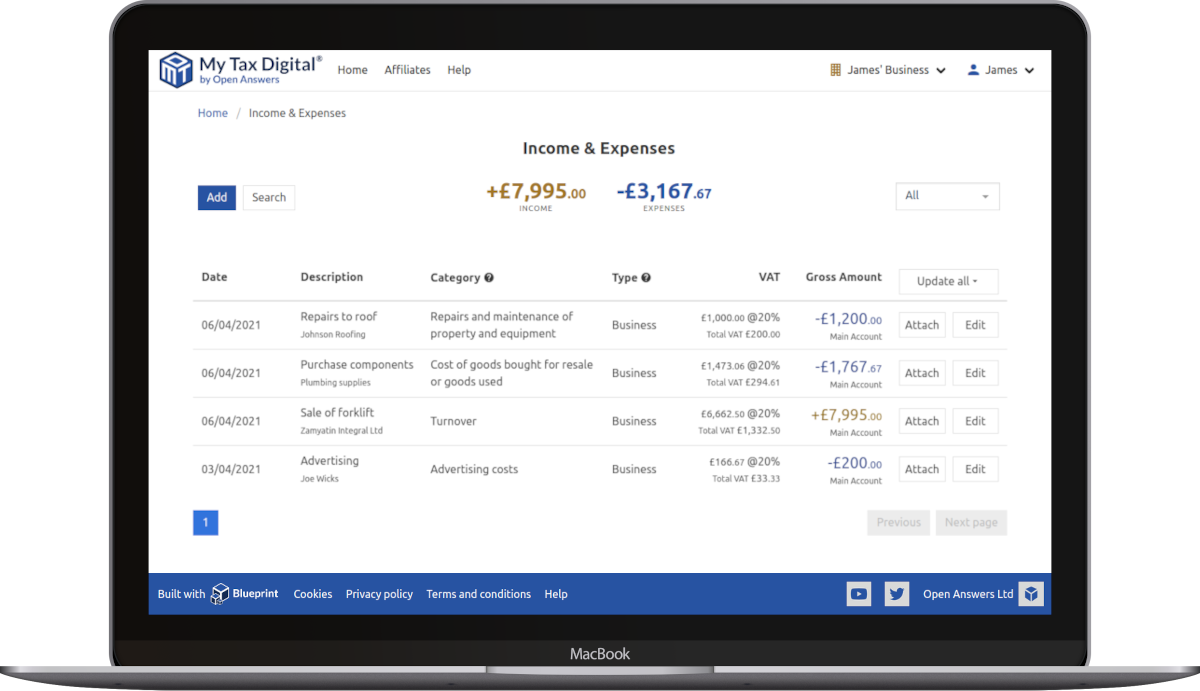

MTD for Income Tax is coming to My Tax Digital.

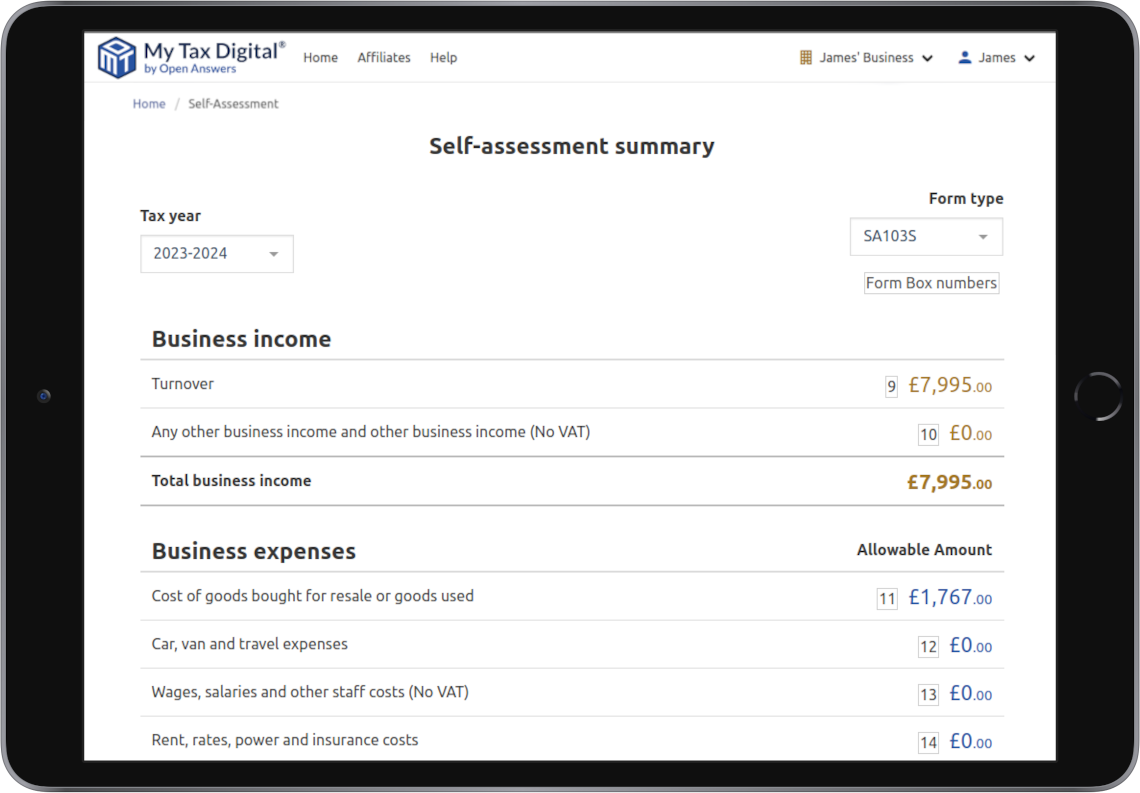

Making Tax Digital for Income Tax Self Assessment (ITSA) is a new system for sole traders and landlords to report income and expenses. It's currently voluntary, but from April 6, 2026, many will need to use it for HMRC tax returns. My Tax Digital will add support for MTD Income Tax soon; check our FAQs for more information.

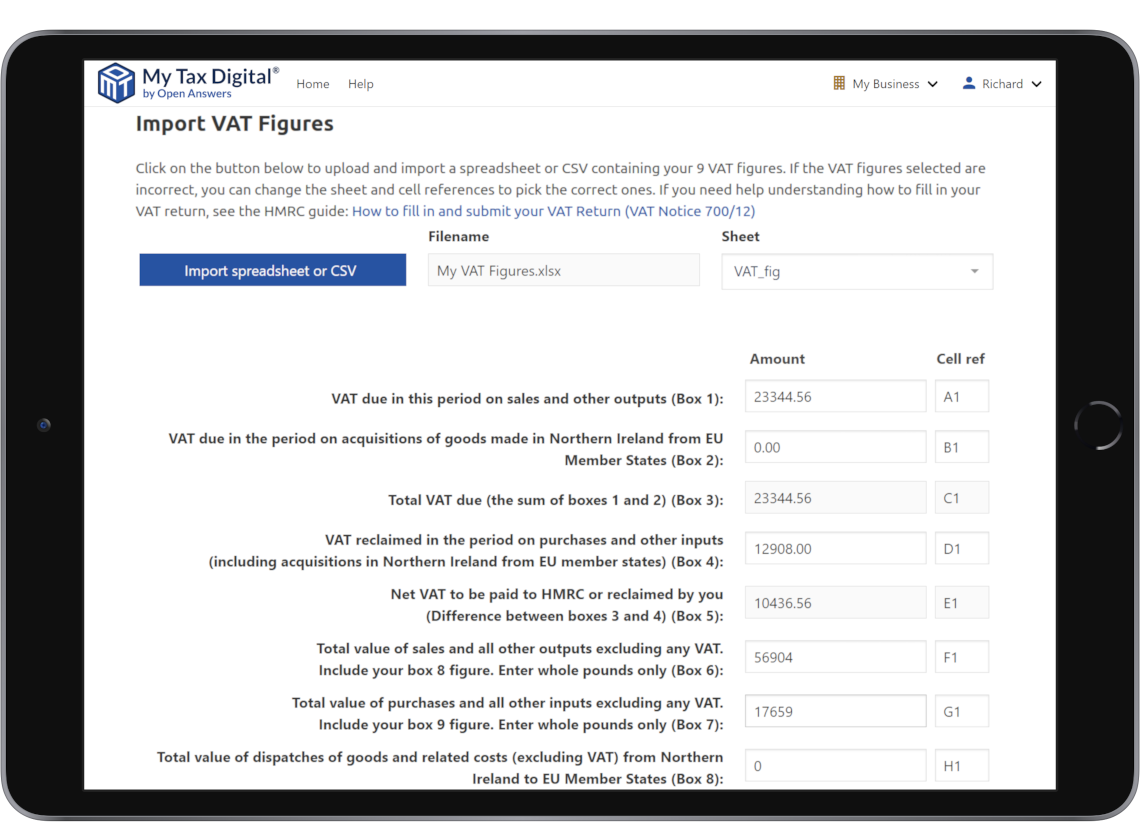

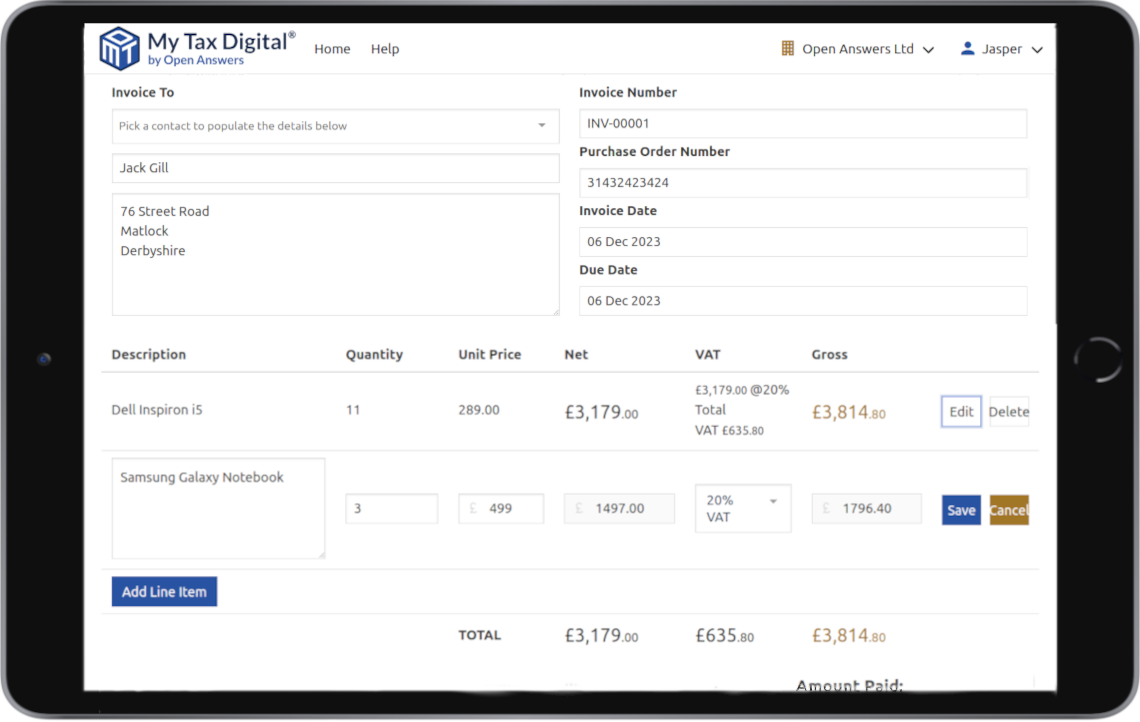

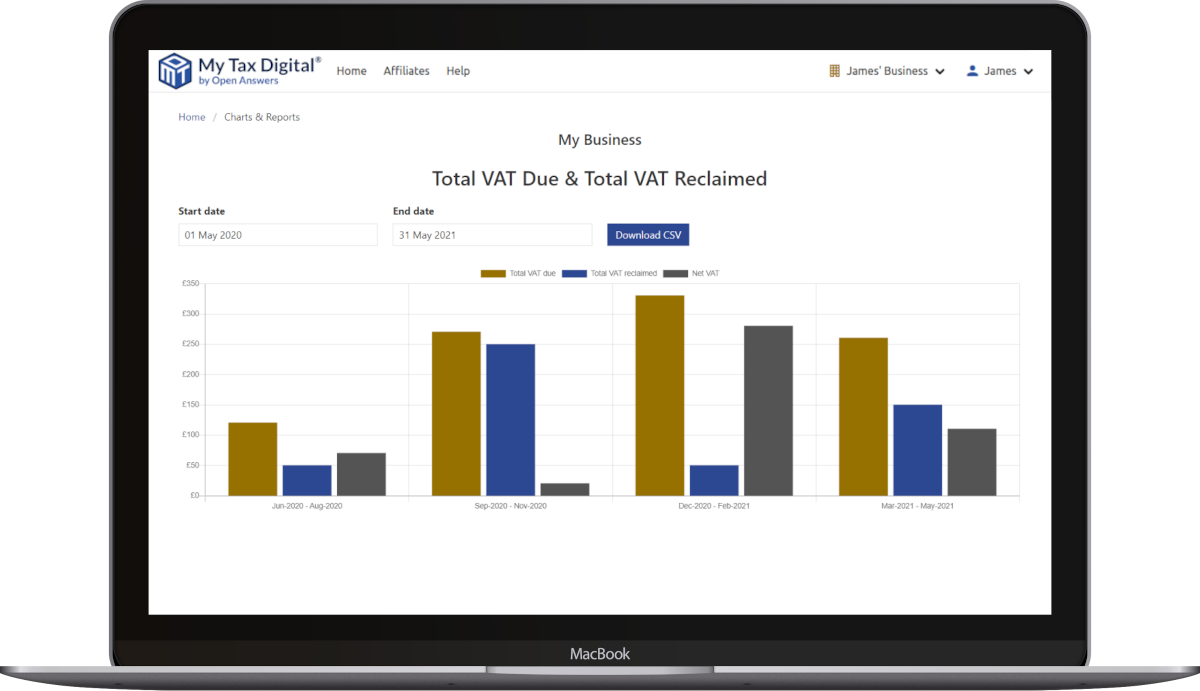

Don't panic about VAT. It's easy to become MTD compliant with My Tax Digital.

All VAT-registered businesses must now file digitally through Making Tax Digital regardless of turnover. My Tax Digital combines the benefits of both digital record keeping and MTD VAT filing into a single free web application allowing you to be MTD compliant. Simply register, sign in and start submitting VAT returns. For more information, see our Getting Started guide.

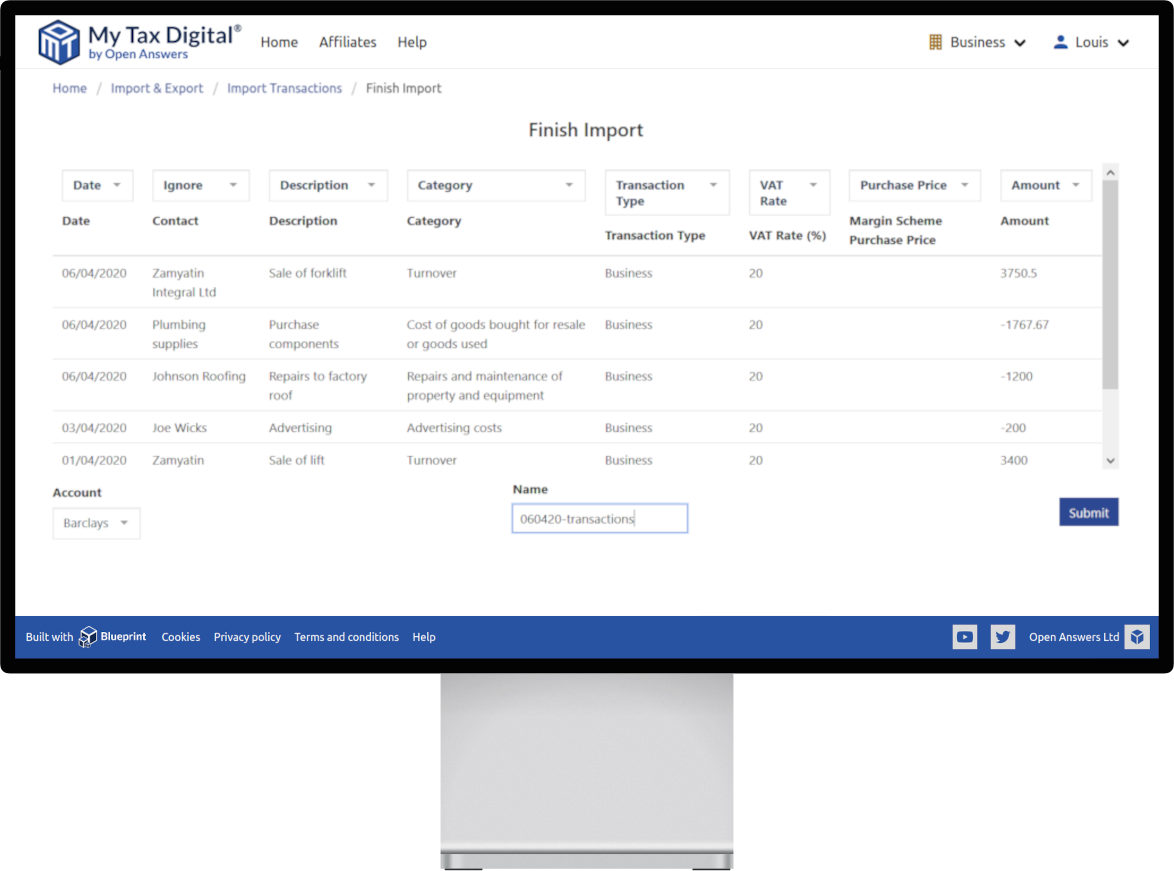

Connect your existing accounting system to HMRC MTD

If your existing accounting system is not MTD-compliant, create a direct digital link from it to HMRC using My Tax Digital. Contact the integration experts Open Answers to discuss options by emailing: info@openanswers.co.uk.