Free MTD for Income Tax Self Assessment

My Tax Digital now supports MTD for Income Tax Self Assessment (ITSA). While currently voluntary, from April 2026, sole traders and landlords with qualifying income over £50,000 must use digital records and MTD-compatible software to submit quarterly summaries to HMRC. You can register and start submitting now. See our Getting Started guide for details.

Free Making Tax Digital for VAT

All VAT-registered businesses must now file digitally through Making Tax Digital regardless of turnover. My Tax Digital combines the benefits of both digital record keeping and MTD VAT filing into a single free web application allowing you to be MTD compliant. Simply register, sign in and start submitting VAT returns. For more information, see our Getting Started guide.

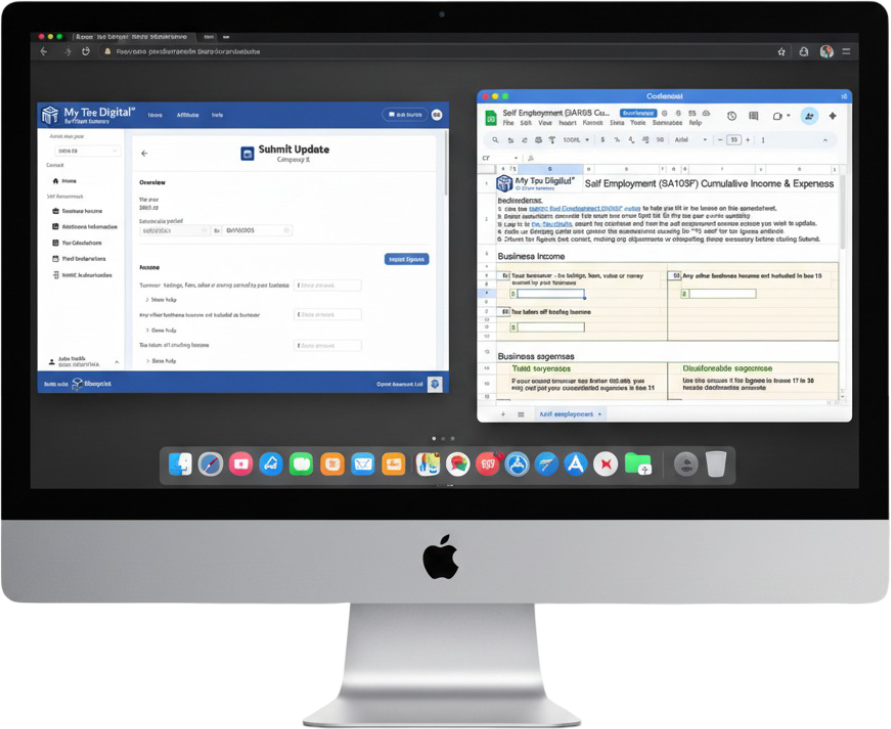

Bridging and Accounting mode

My Tax Digital's Bridging mode facilitates free MTD VAT and Income Tax filing by directly importing your figures from spreadsheets for submission to HMRC. This establishes the required digital link between your spreadsheet and HMRC. Alternatively, Accounting mode allows you to keep digital records of income and expenses and automatically calculates your VAT and Income Tax figures.

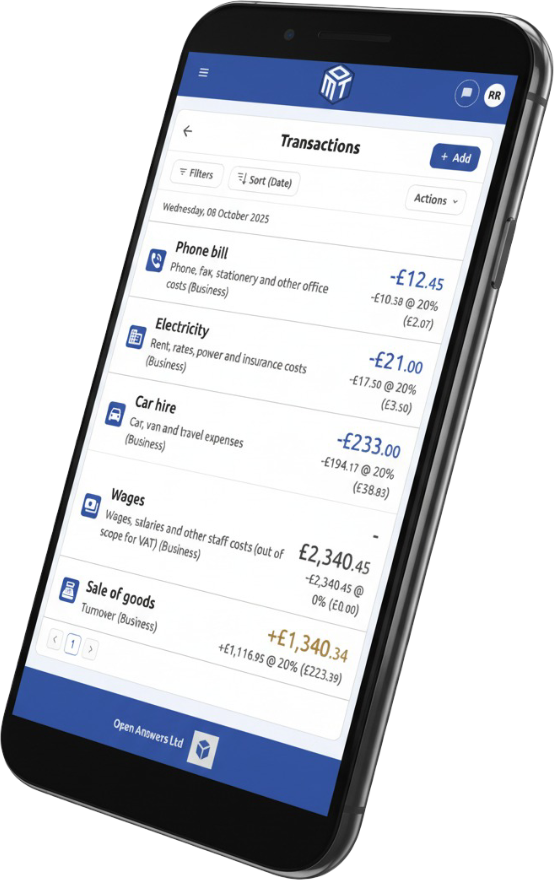

Record and categorise income and expenses

Keep MTD-compliant digital records of all your income and expenses. My Tax Digital handles the categorisation, ensuring you correctly complete your quarterly obligations for VAT and/or Income Tax, for self-employment (SA103S/F), UK property (SA105) and foreign property (SA106).

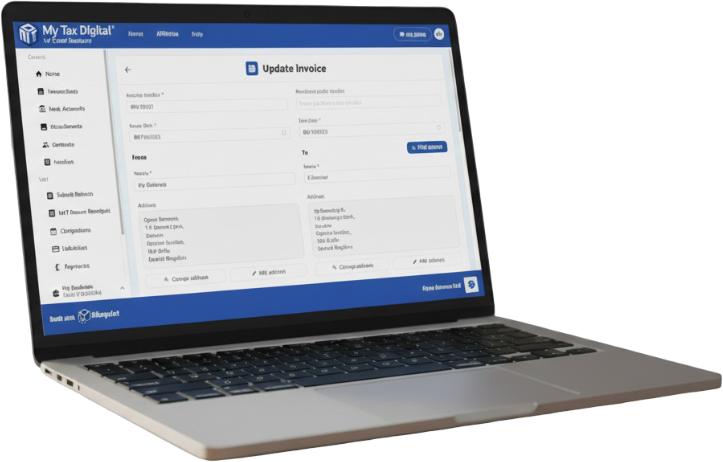

E-Invoicing

The My Tax Digital E-Invoicing feature allows you to quickly and easily create customized invoices to send to your customers. You can create, preview, download, and reconcile invoices, ensuring your business keeps complete digital records and remains compliant with Making Tax Digital (MTD) standards.

Import & export data

Seamlessly import bank transactions and financial records from other accounting software. You can also export your data via CSV for use in applications like Microsoft Excel. This ensures MTD-compliant digital linking and gives you full control over your financial records.

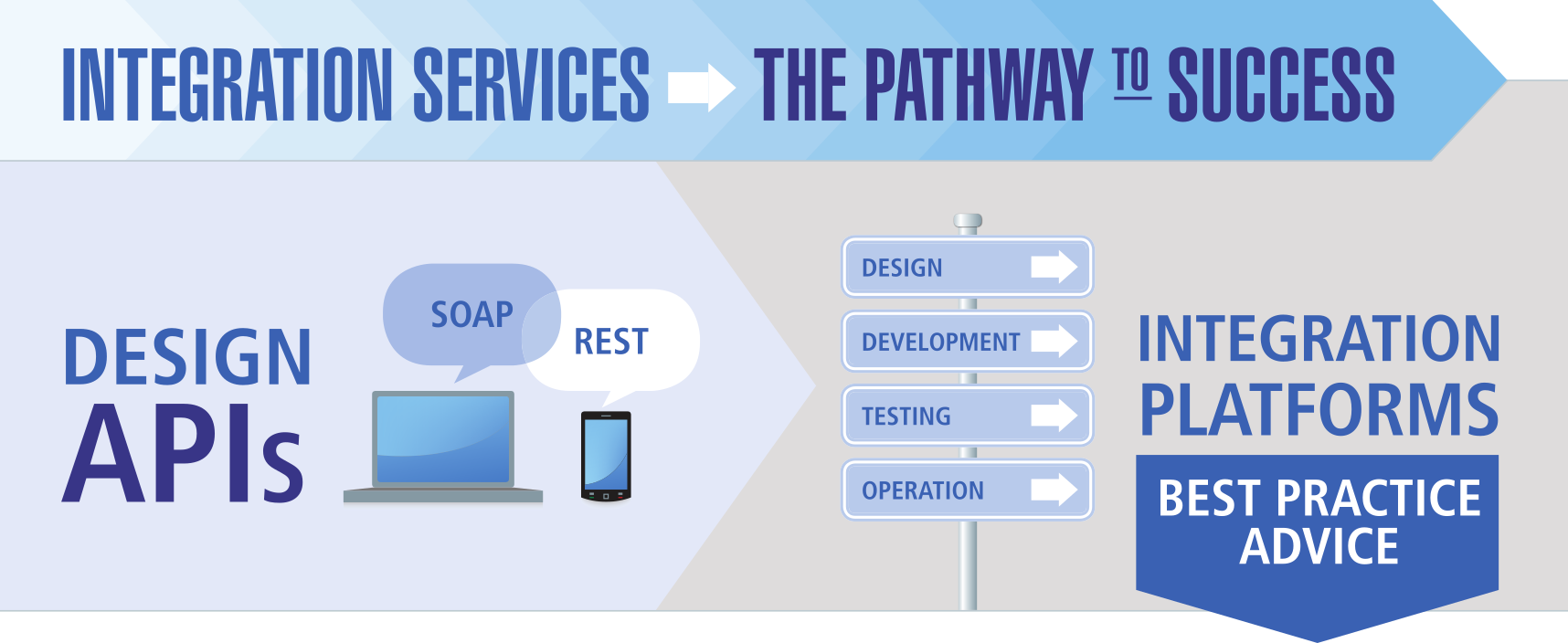

Connect your existing accounting system to HMRC MTD

If your existing accounting system is not MTD-compliant, create a direct digital link from it to HMRC using My Tax Digital. Contact the integration experts Open Answers to discuss options by emailing: info@openanswers.co.uk.