E-Invoicing

The Invoices feature allows you to create, manage, and send professional sales invoices to your customers.

-

Navigate to Invoices: Select Invoices from the main menu (under the General section).

-

Create a New Invoice: Click the blue "+ Add" button in the top-right corner.

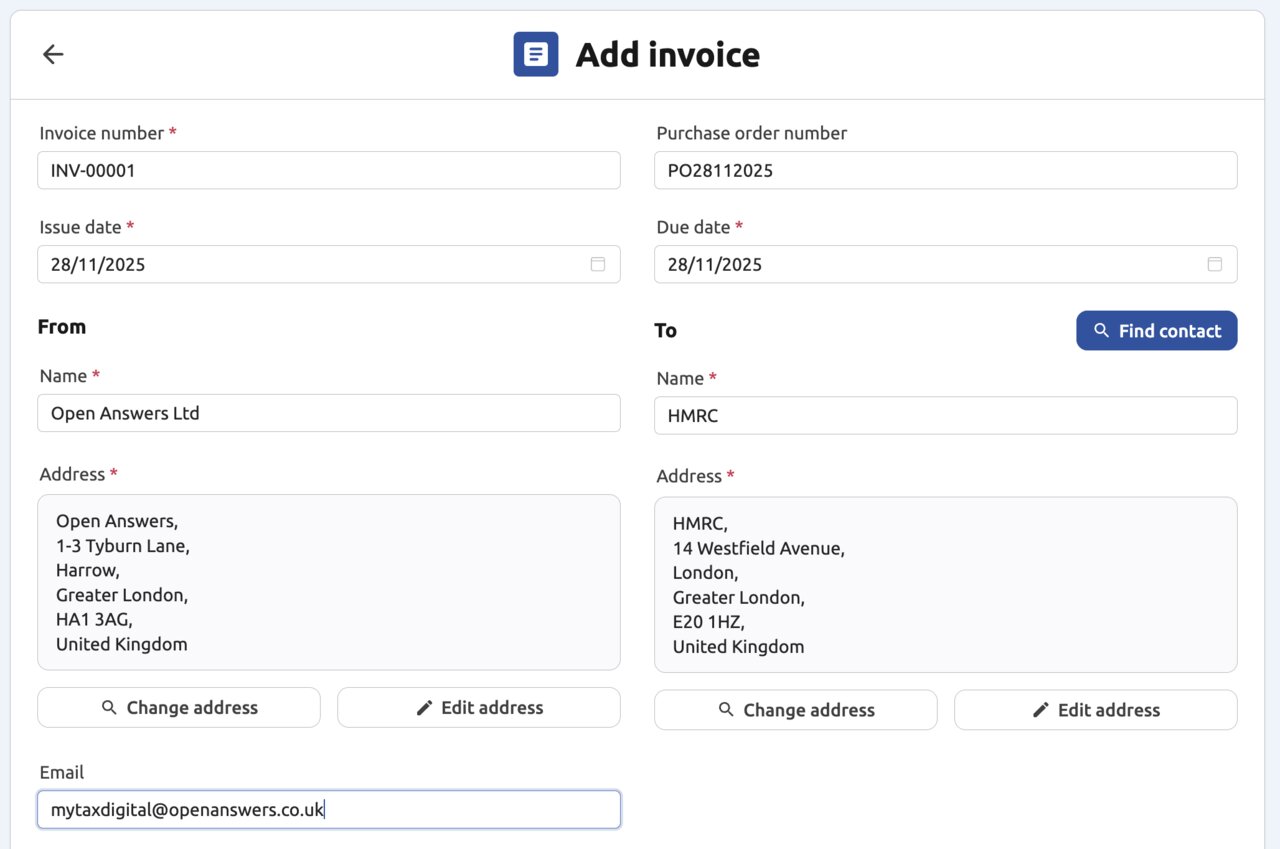

1. Creating the Invoice

-

Header Details:

- The Invoice number is generated automatically, but can be overriden (e.g., INV-00001).

- Enter the Issue date and Due date for the payment.

-

Customer Details (To):

- Click "Find contact" to select an existing customer from your Contacts list, or manually enter the customer's details (Name, Address, Email).

-

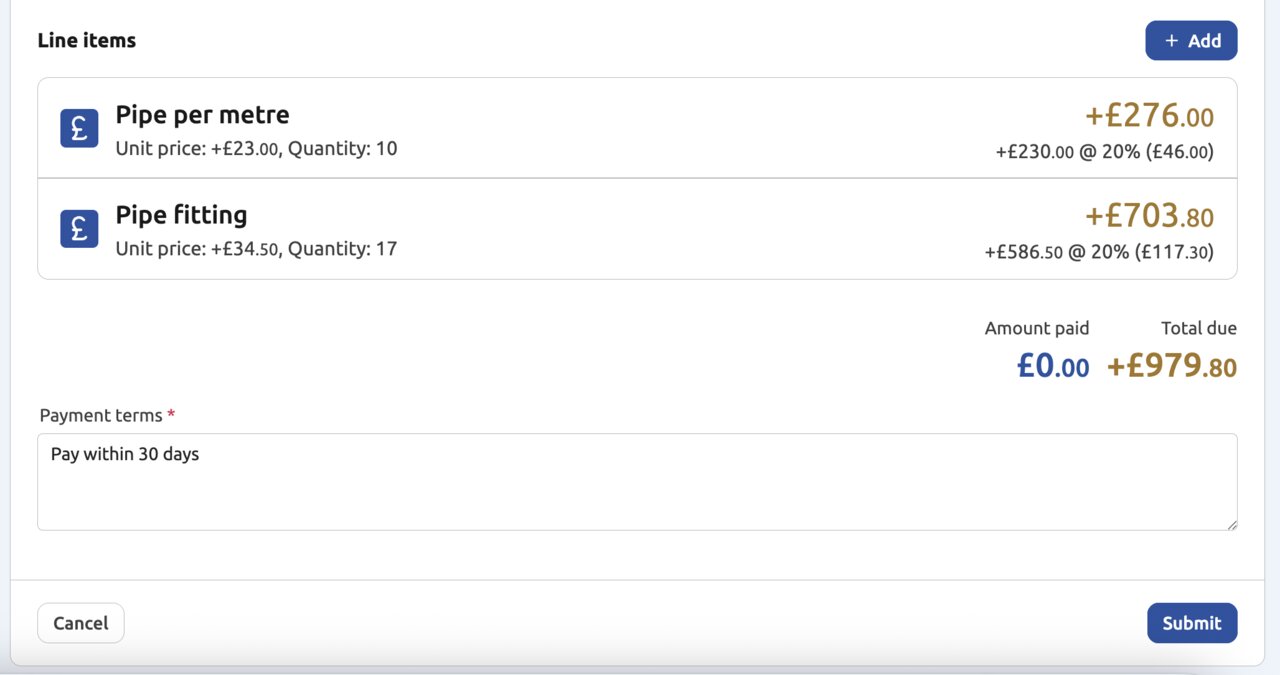

Line Items (Products/Services):

- Click the "+ Add" button below the Line Items section to add a product or service.

- Enter a Description, Quantity, and Unit price.

- Select the correct VAT rate (e.g., 20% VAT). The Total VAT is calculated automatically.

- Click "Confirm" to add the line item. Repeat for all items.

-

Payment Terms: Enter the agreed payment terms (e.g., "30 Days") in the Payment terms box.

-

Save: Click the "Submit" button at the bottom to save and generate the invoice.

2. Matching Payments (Reconciliation)

Once you receive the payment for a sales invoice, you must record it as a transaction to update your bank balance and digital records. My Tax Digital allows you to link the invoice to the transaction.

-

View Invoice: Open the specific invoice you want to mark as paid.

-

Match Transaction: Scroll down to the Associated Transactions section and click "+ Add".

-

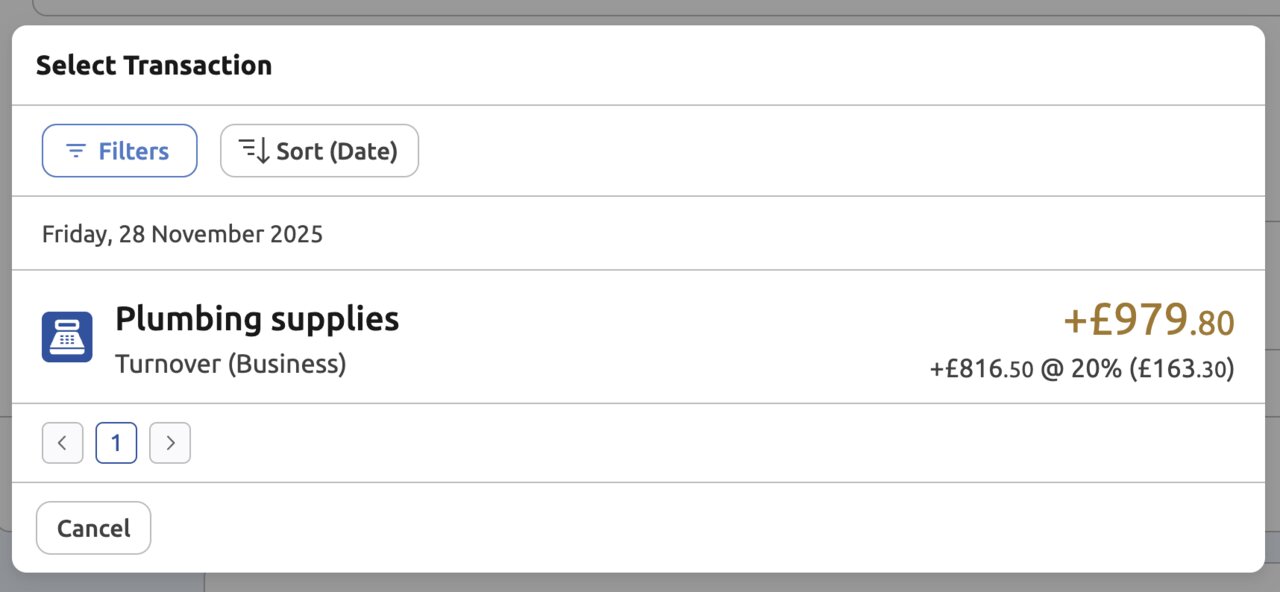

Select Transaction: A window will appear showing recent income transactions. Click on the transaction that represents the customer's payment (e.g., Sales +£1,000.00).

-

Match: Clicking on the transaction links it to the invoice. The invoice will now display the amount paid and the total due will show £0.00.

-

Download: Click on "Manage" then "Download invoice" to download a PDF of the invoice which can either be printed or emailed to the customer.