Your Account

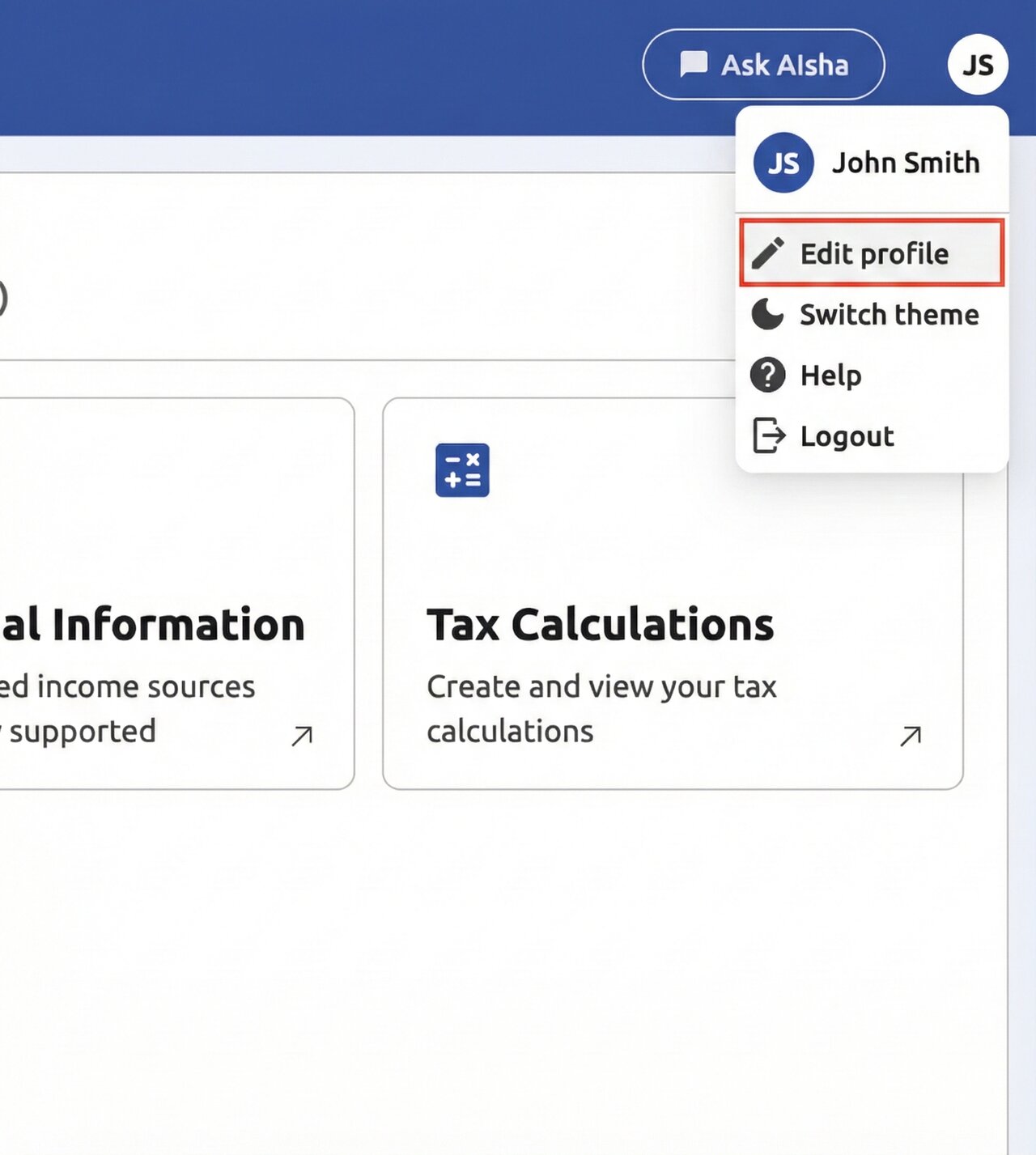

Accessing Your Profile Settings

To access your profile settings to make changes to your personal details or security:

- Click on your name (or the circle with your initials, e.g., JS) in the top right corner of the dashboard.

- Select Edit profile from the dropdown menu.

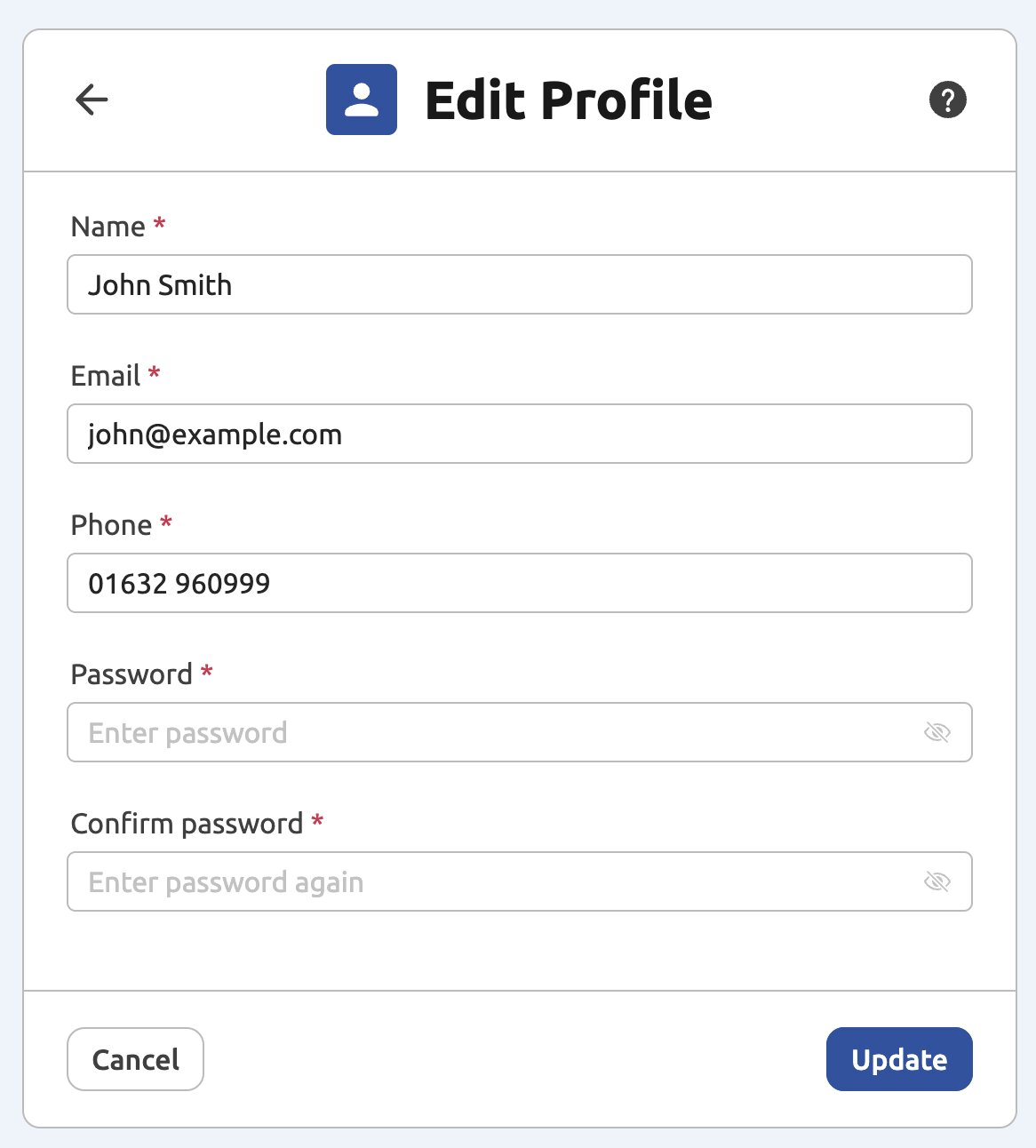

Updating Your Details

- Once on the Edit Profile page, you can modify the following fields:

- Name

- Phone

- After making your changes, click the Update button at the bottom of the form to save them.

Updating Your Password

- Navigate to the Edit Profile page.

- Locate the password section containing the Password and Confirm password fields.

- Type your new password into the first field, and re-type it in the second field to confirm.

- Click the Update button.

Setting up Multi-factor Authentication (MFA)

Multi-factor authentication provides an extra layer of security. While email MFA is available as a backup, you can set up mobile authentication for daily use.

- On the Edit Profile page, scroll down to the Multi-factor Authentication section.

- Click the Setup mobile MFA button.

- A Setup OTP window will appear with the following steps:

- Step 1: Download an authentication app (Google Authenticator is recommended for iPhone or Android).

- Step 2: Open your authentication app and scan the QR code displayed on the screen.

- Step 3: Enter the code generated by your app into the Secure passcode field.

- Click Submit to finalize the setup.

Delete Account

Please note: Account deletion is a one way process and it is impossible to restore your account after deletion. Please read the details below carefully before proceeding.

Deleting your account will remove any Businesses or Individuals you created even if you have shared them with other users. Businesses or Individuals shared with you, but created by other users will not be deleted.

If you wish to proceed with account deletion you must enter the email address associated with your account.