Adding new Businesses and Individuals

My Tax Digital supports both MTD for VAT and MTD for Income Tax Self Assessment.

-

Add new: From left hand menu, find and click the button labelled "+ Add new".

-

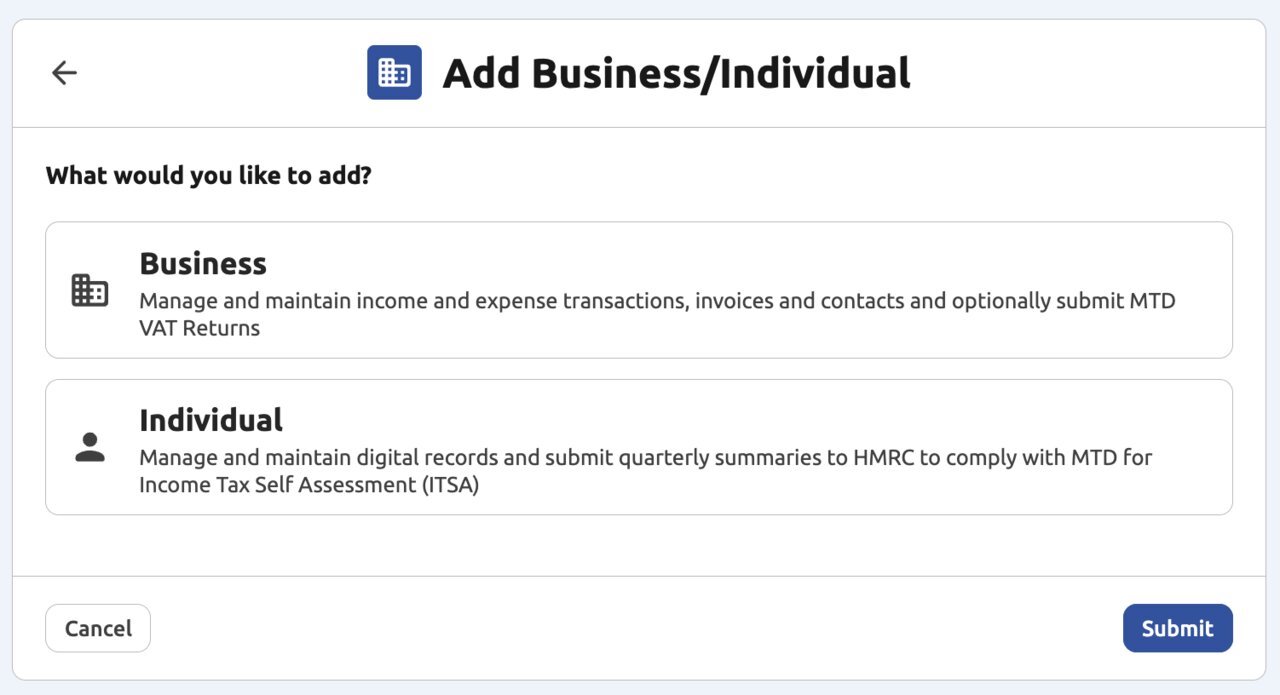

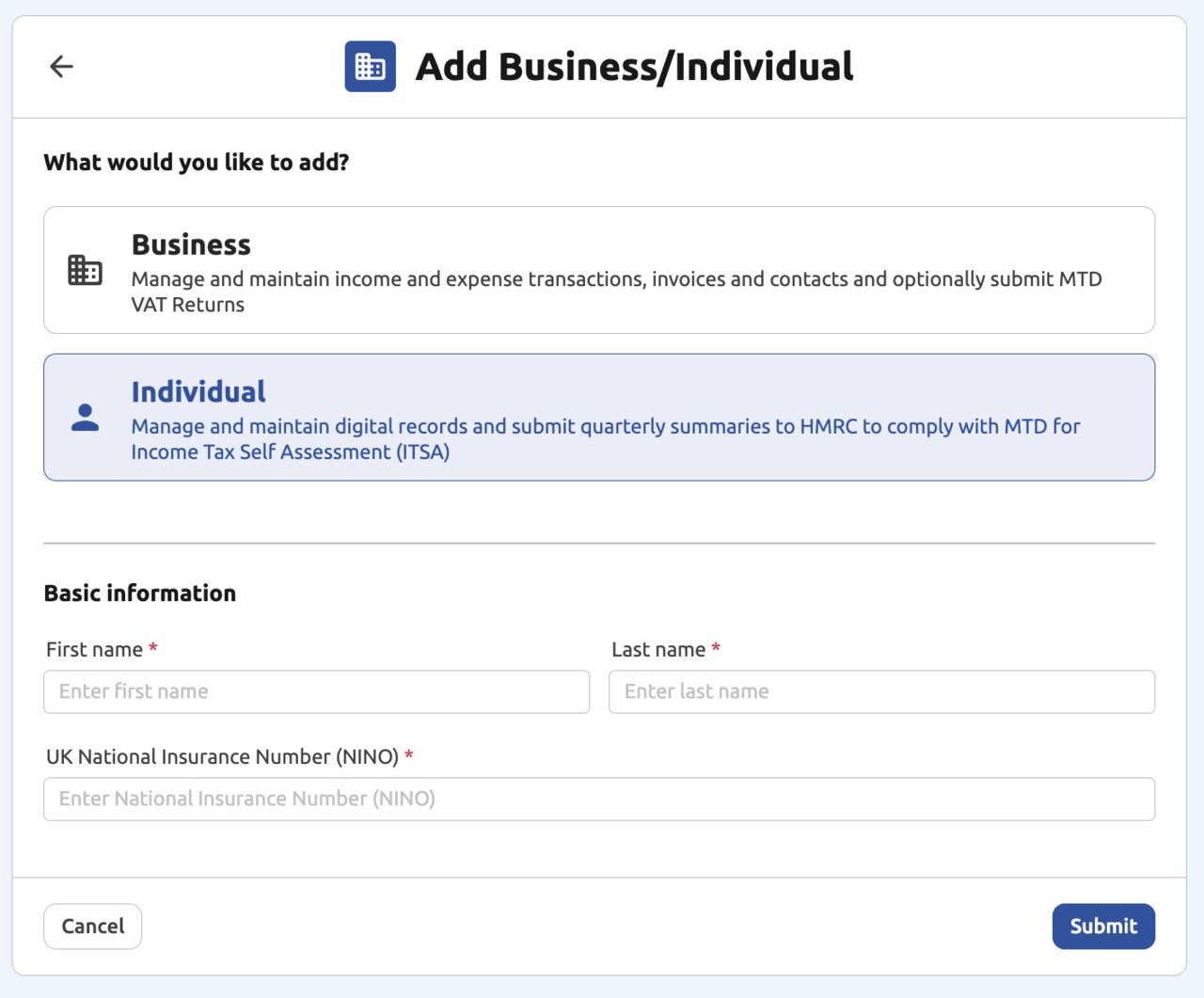

Choose Business or Individual: The screen asks, "What would you like to add?" Select one of the two main options based on your tax requirements:

- Business: Manage and maintain income and expense transactions, invoices and contacts and optionally submit MTD VAT Returns

- Individual: Manage and maintain digital records and submit quarterly summaries to HMRC to comply with MTD for Income Tax Self Assessment (ITSA)

- Complete the Form for Your Choice: The form fields will change depending on whether you chose 'Business' or 'Individual'.

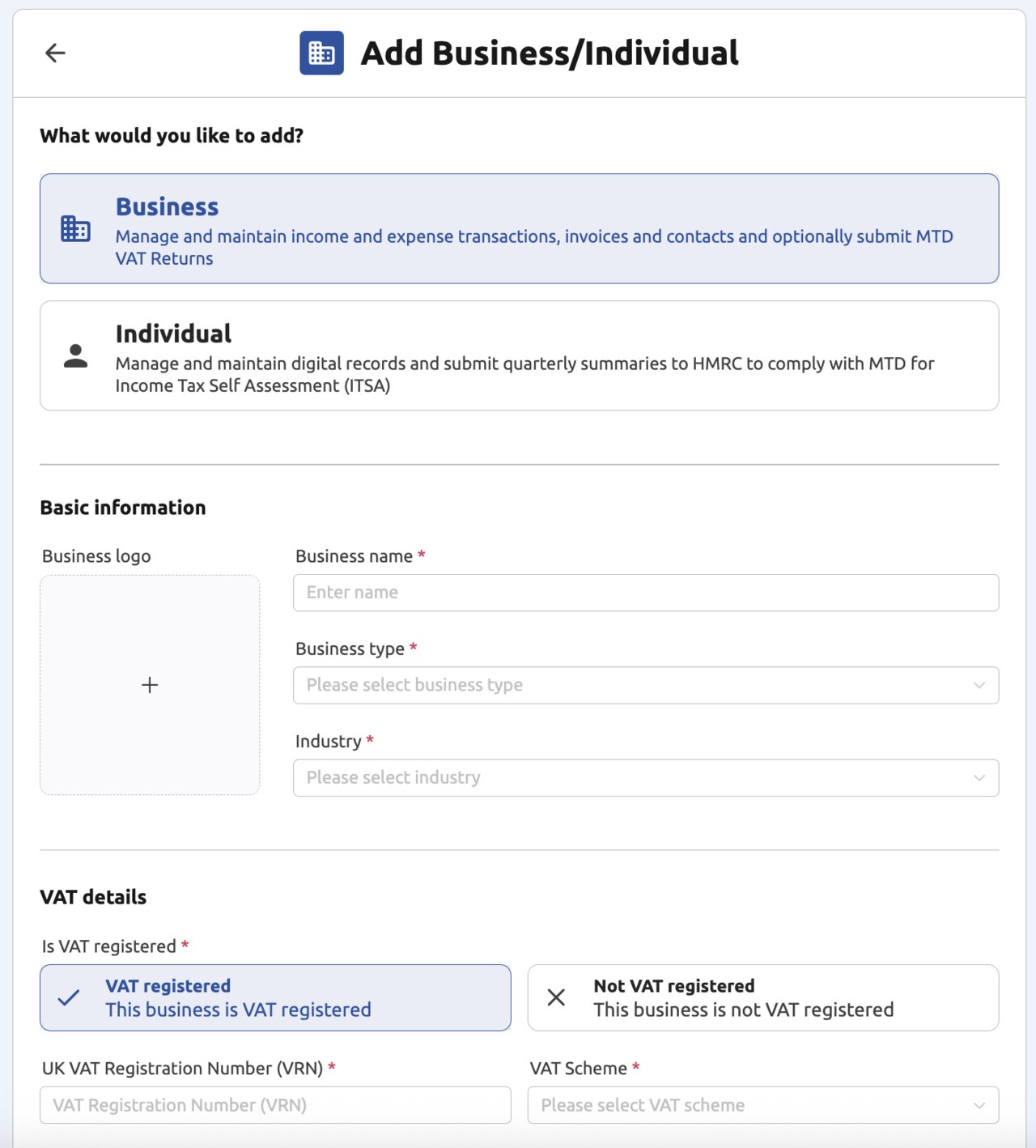

If you selected 'Business' (MTD VAT):

-

Basic Information:

- Enter the Business name.

-

VAT Details:

- Indicate if the business is VAT registered or Not VAT registered.

- If 'VAT registered' is selected, enter the UK VAT Registration Number and select your correct VAT Scheme (e.g., Standard, Flat Rate, Cash Accounting) from the drop-down list.

-

Business Contact Details:

- Enter the registered business Address (you can search or manually enter).

- Enter the required contact information: Email and Phone (work).

- Select the Business Type and Industry from the available lists.

- If you are a Limited Company, you may also enter your Company Registration Number (CRN).

If you selected 'Individual' (MTD ITSA):

-

Basic Information:

- Enter your First name and Last name.

- Enter your UK National Insurance number (NINO).

- Submission: Once all mandatory fields (marked with a red asterisk) are complete, click the "Submit" button to finalise the addition of your business or individual.